This article provides an Overview of the Analyze Phase in the Accounting Transformation Implementation in Accounting Hub Cloud.

Analyze and Identify the Transaction Lifecycle of Source Systems

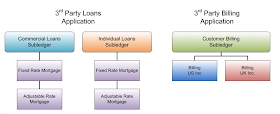

First, the number of custom subledgers to be created should be determined. In our example, we have separate third-party systems for commercial and individual loans, and a billing application. Depending on how your organization uses these third-party systems, we may want to register them as separate subledgers or just one subledger. Below is a quick comparison between the two:

Unified Subledger

|

Separate Subledgers

|

Share subledger accounting rules

|

Provides more security across

applications

|

Lets you report across all data

easily

|

less data in each processor,

performance will be much faster

|

accounting process can be run

simultaneously for different applications

|

|

much less likely to contend for

database resources

|

For example, If the commercial and individual loan systems will be registered as a single, unified subledger, data for processing will be huge and this might impact system performance. On the other hand, this actually saves time, because we can re-utilize the subledger accounting rules. So considering these points, you will have to figure out whether it is a wise decision to go with separate or unified subledgers.

Another point that we have to keep in mind is that, we need to determine what source data is required to create subledger journal entries. You should not bring each and every transaction from the source system into Accounting Hub, rather, only transactions which need to be accounted for. You need to analyze the source systems and determine what transaction types to capture and what transaction types should be considered for accounting purposes.

Another point that we have to keep in mind is that, we need to determine what source data is required to create subledger journal entries. You should not bring each and every transaction from the source system into Accounting Hub, rather, only transactions which need to be accounted for. You need to analyze the source systems and determine what transaction types to capture and what transaction types should be considered for accounting purposes.

In the loan system example, we have the following activities in your source system:

- loan origination

- loan interest approval

- loan interest accrual reversals

- loan scheduled payments

- loan late payments

- loan charge-offs

A transaction type and it's associated transaction data typically relates to a single document or transaction in the source system. Transaction types will become accounting events in the Accounting Hub Cloud, and for each of those accounting events, we must generate the accounting entries.

Next point that we need to keep in mind is to figure out how frequent do you want the data to come from the source system. This will depend on the immediacy and volumes of accounting requirements in your company. It should not be scheduled during the day when your database resources are being consumed at a high level.

Also, you will have to evaluate if you will bring each and every individual customer transaction from the source system, or just the summarized activity for a customer that you have managed throughout the day.

Analyze the Accounting, Reporting, Auditing, and Reconciliation Requirements for Transaction Types

This analysis should, at a minimum, answer a couple of questions, such as:

Under what condition does each of the subledger journal entry lines get created? Is it upon the loan approval or when the loan has been entered in the source system? You need to identify the event when the transaction should be picked from the source system.

What is the line type of each subledger journal entry line, debit or credit? You need to figure out if a transaction will use a debit line or the credit line. For example, the transaction "Loan Origination" will have a debit line for loan receivable account and a credit line for cash or bank account.

What description should be used for the subledger journal entry? This determines the description the subledger journal entry will have for each transaction type. This will be useful for reconciling the subledger journal entry to the source system.

Under what condition does each of the subledger journal entry lines get created? Is it upon the loan approval or when the loan has been entered in the source system? You need to identify the event when the transaction should be picked from the source system.

What is the line type of each subledger journal entry line, debit or credit? You need to figure out if a transaction will use a debit line or the credit line. For example, the transaction "Loan Origination" will have a debit line for loan receivable account and a credit line for cash or bank account.

What description should be used for the subledger journal entry? This determines the description the subledger journal entry will have for each transaction type. This will be useful for reconciling the subledger journal entry to the source system.

How are the accounts derived for the entry? This determines how are the account segment values for each of the segment in your chart of account will be retrieved. What logic is needed to be applied to identify the account segment values of each transaction type.

What additional information may be useful for reconciling the subledger journal entry to the source system? You would need to identify what additional information needs to be captured that will be useful for reconciling the subledger journal entry to the source system.

These transaction identifiers can help you easily reconcile journal entries. Specify which fields you want to map against those 10 transaction identifiers to, and when the accounting entries are generated, the system will populate the values of those transaction identifiers at the journal entry level. These transaction identifiers can be utilized for designing either the description rules or the account rules. Example transaction attributes may include:

- Amounts (including entered and accounted amounts)

- Dates (such as accounting date and transaction date)

- Descriptions

- Journal Ledger accounts

- Customer Information

- Transaction Type Information

- Product Information

- Salesperson

- Loan Type

Transaction Identifier Example

From the above loan source system example, the transaction "Loan origination" is the debit line, and Cash is the credit line.

Observe that the Account column shows different values. Analyze whether the entire combination or each of the individual segments will follow a specific rule to retrieve the values. Those values could be based on the transaction attributes that were brought from the source system. This can be achieved with a mechanism called mapping sets.

For example, the value for the Line of Business segment (segment 2) can be based on the salesperson who is tied to that transaction line. Below, If the transaction was tied to Mr John Doe, the Line of Business Segment is 10. Additionally, the cost center segment can be dependent on the loan type. If the loan type is an adjustable rate, the value for the cost center would be "0000" and if the loan type is fixed rate, the cost center value is "2120".

When you have listed all the transaction attributes that are required to obtain the appropriate accounting entries from the Accounting Hub Cloud and visualized all these details, you will be able to retrieve the values for your chart of account segment and map them into the application. And based on that, the journal entry will be created.

Accounting Attributes

Next, we need to figure out, what are the accounting attributes that we need to assign for our source system. So the Create Accounting process basically utilizes the values of the sources assigned to accounting attributes and accounting rules to create subledger journal entries.

Each accounting attribute is associated with a level when you create the subledger journal entries. It could be the header level definition, or it may be the line level definition. Below are the mandatory accounting attributes and source assignments, these must be used whenever you are registering your source systems.

Accounting Attribute

|

Predefined Source Assignment

|

Accounting Date

|

Transaction Date

|

Distribution Type

|

Accounting Event Type Code

|

Entered Amount

|

Default Amount

|

Entered Currency Code

|

Default Currency

|

First Distribution Identifier

|

Line Number

|

Accounting Hub Cloud basically pre-defines transaction dates as accounting date. So whatever is your transaction date, that is identified by Accounting Hub as accounting date. The Create Accounting process will use this to derive the accounting date of the journal entries. There is another option that we have to keep in mind as far as accounting date is concerned, that is called accrual reversal accounting date source. This attribute is relevant to applications that must perform automatic reversal on accrual journal entries at a specified date or period. You can assign application and standard date sources to the accrual reversal accounting date on the Accounting Attribute Assignment page.

The First Distribution Identifier information is equivalent to the line number in the predefined source assignment. This basically links the subledger transaction distributions to their corresponding journal entry lines.

So these are the accounting attributes that we should always keep in mind, and they will always be associated to a predefined source assignment.

For more full-detailed Tutorials and Tips, check out #TheOracleProdigy at https://lifeofanoracleprodigy.blogspot.com/

Follow The Oracle Prodigy on Facebook (https://www.facebook.com/theOracleProdigy/) and Twitter (https://twitter.com/D_OracleProdigy)